TORONTO, Canada, November 14, 2024 – Neo Performance Materials Inc. (“Neo“) (TSX:NEO) released its third quarter 2024 financial results. The financial statements and management’s discussion and analysis (“MD&A“) of these results can be viewed on Neo’s website at www.neomaterials.com/investors/ and on SEDAR+ at www.sedarplus.ca.

Key Takeaways

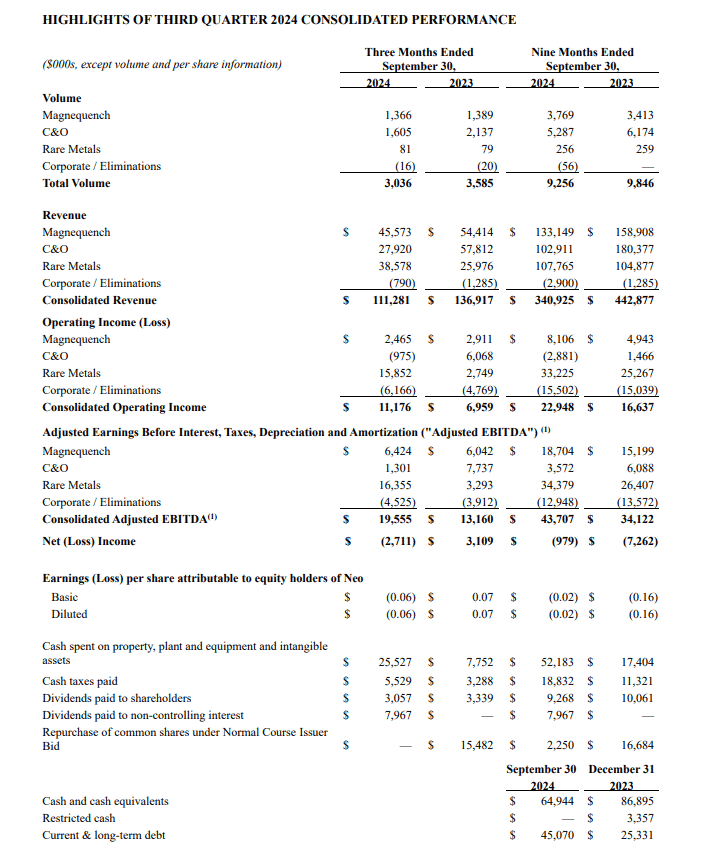

| 1. | Increased Adjusted EBITDA(1): Neo reports strong financial results of $19.6 million of Adjusted EBITDA(1) for Q3 2024 and $43.7 million of Adjusted EBITDA(1) for the nine months ended September 30, 2024. Year-over-year Adjusted EBITDA(1) increased for both Magnequench and Rare Metals by 23% and 30%, respectively. |

| 2. | Construction Nearing Completion on European Sintered Magnet Facility: Neo’s sintered magnet facility in Europe is on track, with construction completed on the core manufacturing building and all critical equipment ordered. In August 2024, Neo secured a major contract with a European automotive supplier, covering 35% of the plant’s peak capacity, with production slated for the second half of 2026. |

| 3. | Credit Facility Secured for Sintered Magnets Facility in Europe: In November 2024, Neo secured a $50 million credit facility from Export Development Canada, with a five-year term to support final construction, equipment purchases and commissioning of the facility. |

| 4. | Business Simplification through Divestment: In line with Neo’s strategy to focus on high-margin, downstream business areas, Neo has announced it has entered into agreements to divest three facilities (two of which are in China), which are expected to generate over $30 million in aggregate cash proceeds, and to reduce earnings volatility and inventory. |

| 5. | Grand Opening of Auto Catalyst Plant: In September 2024, Neo celebrated the opening of NAMCO, its new auto catalyst plant in Asia. On-time and on-budget, the facility has requalified the majority of its product portfolio and is on track to finalize the remaining products in the coming months. |

| 6. | Strategic Review Progressing: Neo’s financial advisors are advancing the Special Committee-led strategic review process, and Neo continues to take steps to optimize its business, including the divestment of non-core assets and the improvement of operational performance. |

| 7. | Growth Outlook: Neo increased its previous outlook for fiscal 2024, from $45-$50 million of Adjusted EBITDA(1), to $52-$55 million. |

(1)Neo reports non-IFRS measures such as “Adjusted Net Income”, “Adjusted Earnings per Share”, “Adjusted EBITDA”, “Adjusted EBITDA Margin” and “EBITDA”. Please see information on this and other non-IFRS measures in the “Non-IFRS Measures” section of this news release and in the MD&A, available on Neo’s website at www.neomaterials.com and on SEDAR+ at www.sedarplus.ca

Q3 2024 Highlights

(unless otherwise noted, all financial amounts in this news release are expressed in United States dollars)

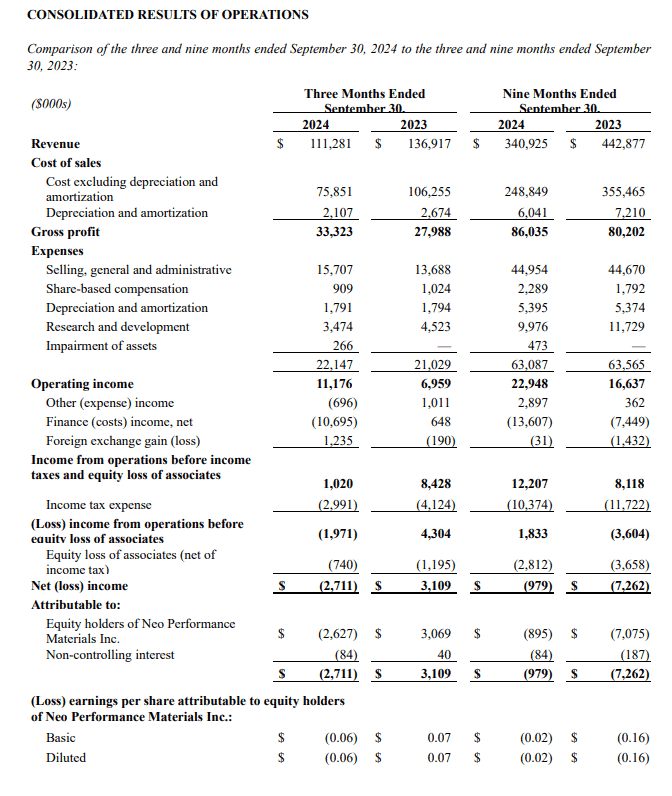

- Neo’s Q3 2024 revenue was $111.3 million, compared to Q3 2023 revenue of $136.9 million.

- Operating income for Q3 2024 was $11.2 million, compared to Q3 2023 of $7.0 million. On a year-to-date basis, 2024 operating income was $22.9 million, compared to $16.6 million in 2023.

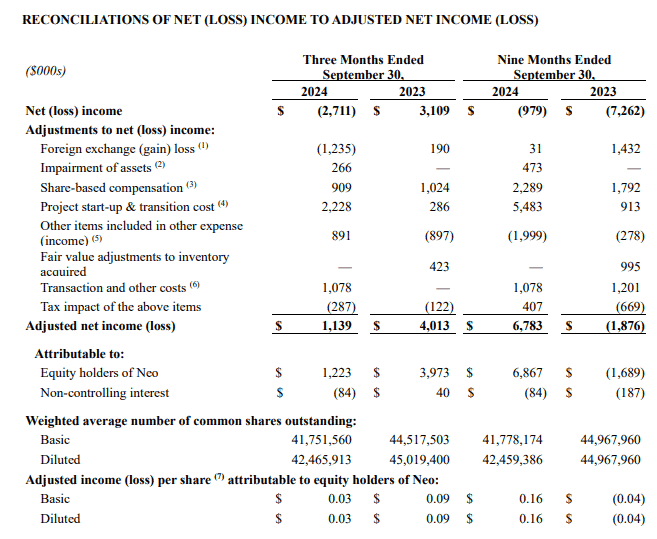

- Adjusted Net Income(1) for Q3 2024 was $1.1 million, or $0.03 per share, compared to Q3 2023 Adjusted Net Income(1) of $4.0 million or $0.09 per share.

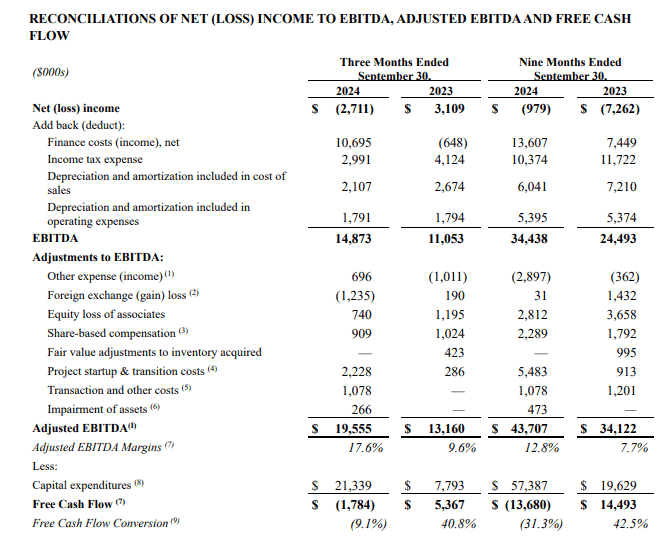

- Adjusted EBITDA(1) for Q3 2024 was $19.6 million, compared to Q3 2023 of $13.2 million. On a year-to-date basis, 2024 Adjusted EBITDA(1) was $43.7 million, compared to $34.1 million in 2023.

- On a year-to-date basis, 2024 Adjusted EBITDA(1) margin as a percentage of revenue increased to 12.8% from 7.7%, an improvement of 510 basis points from the prior year. Despite lower rare earth prices negatively impacting revenue, Adjusted EBITDA(1) was unaffected because of Neo’s positioning as a value-added downstream business with much of the commodity inputs tied to pass-through agreements.

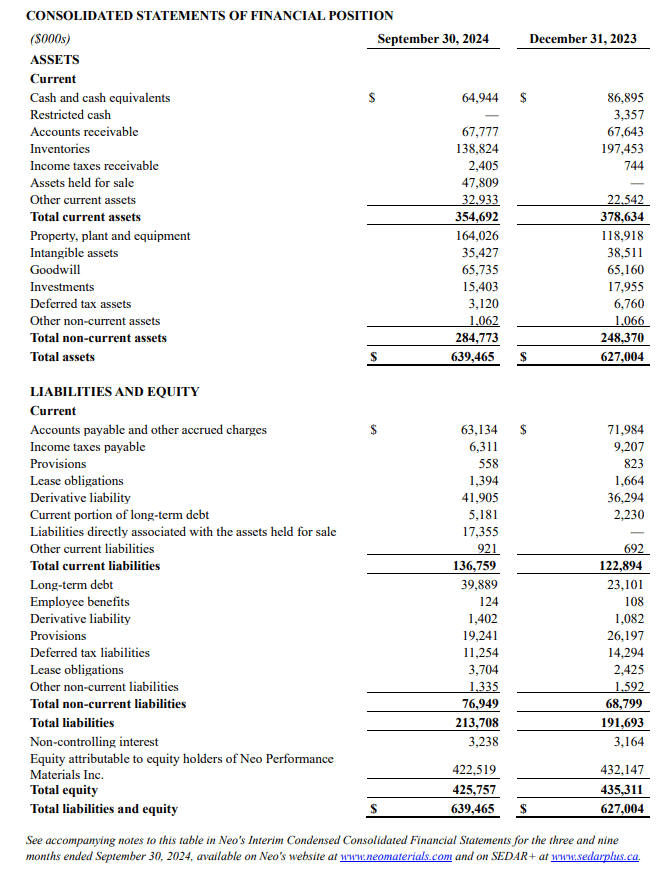

- Neo had $64.9 million in cash and $45.1 million in gross debt on its balance sheet as of September 30, 2024. Neo invested $52.2 million in capital expenditures for the nine months ended September 30, 2024, including sustaining capital expenditures of $3.1 million.

- Neo distributed $9.3 million in dividends to Neo’s shareholders and repurchased for cancellation $2.3 million of common shares in the first nine months of the year.

- A quarterly dividend of Cdn$0.10 per common share was declared on November 13, 2024, for shareholders of record on December 17, 2024, with a payment date of December 27, 2024.

“Neo is pleased to report another solid quarter, with Adjusted EBITDA(1) up approximately 50% year-over-year to $19.6 million and 30% year-to-date. This performance, driven by growth in our Magnequench and Rare Metals business units, reaffirms our business strategy and approach,” said Rahim Suleman, Neo’s President and Chief Executive Officer. “Our focus on high-margin, downstream opportunities and strategic simplification of the business is generating tangible results for shareholders.”

“Recent asset dispositions anticipated to generate over $30 million in cash will streamline our portfolio and are anticipated to reduce our business volatility,” continued Mr. Suleman. “With our new NAMCO facility now operational and our European magnet project advancing, we are well-positioned to gain market share in higher-margin downstream businesses. Our progress over the past year sets a strong foundation for continued value creation and sustainable growth.”

SOLID FINANCIAL PERFORMANCE DESPITE INDUSTRY HEADWINDS

- In Q3 2024, Magnequench achieved its highest quarterly volume of the year, driven by strong traction motor sales and spot demand in bonded powder.

- Magnequench is well-positioned in the traction motor market, offering the only heavy rare earth free magnet for traction motor platforms. Neo’s future growth looks promising with the addition of a new sintered magnet facility currently under construction in Europe.

- Neo’s Chemical & Oxides (“C&O“) business unit experienced weaker performance, largely driven by lower rare earth prices that impacted the rare earth separation business. To address this and reduce volatility, Neo has strategically shifted focus to Europe by entering into agreements to divest its two rare earth separation facilities in China.

- This move aligns with Neo’s broader strategy to focus on higher-margin, downstream applications. C&O’s asset base, post-divestiture, will be comprised of its European separation business and the newly built NAMCO facility for global auto catalyst customers, while still maintaining specialty heavy rare earth sales to international customers.

- Neo’s Rare Metals business unit saw impressive growth in Q3 2024, which significantly contributed to Neo’s overall performance.

- A major factor in this strong showing was exceptional pricing for hafnium, which bolstered revenue and Adjusted EBITDA(1) over the past several quarters. Neo expects hafnium pricing to normalize gradually but remains well-positioned to satisfy global demands for critical metals, including hafnium, niobium, gallium and tantalum.

SINTERED MAGNET FACILITY CONSTRUCTION ON-TIME AND ON-BUDGET

- Neo is expanding its European footprint with the construction of a sintered magnet facility in Estonia. This project is set to drive Neo’s growth by positioning the Company as a leading magnet supplier in Europe while supporting sustainable and secure local supply chains for critical materials. The project remains on-schedule and on-budget.

- The plant is strategically located near Neo’s rare earth separation facility and is designed to support demand for clean energy technologies, including electric vehicle traction motors and wind turbines.

- Neo has taken a phased investment approach, with Phase 1 providing an initial capacity of 2,000 tonnes per year, with the potential to expand to 5,000 tonnes per year.

- Neo estimates that Phase 1 of the new sintered magnet facility in Europe will cost $75.0 million before the European Union grant. Neo has spent $32.7 million in the first nine months of 2024 and $41.7 million in capital expenditures since the project began.

- In August 2024, Neo received its first major contract for this facility from a Tier 1 European automotive supplier, with production expected to start in the second half of 2026.

- In November 2024, Neo secured a $50.0 million credit facility from Export Development Canada (“EDC“), with a five-year term to support final construction, equipment purchases and commissioning of the facility.

IMPROVED OPERATIONAL PERFORMANCE

- Operational improvements in Neo’s Magnequench operating facilities in Asia, including a 20% reduction in conversion costs, have also strengthened margins, enhancing the business’ financial performance.

- The NAMCO facility reached significant operational milestones in 2024, with its official grand opening in September.

- Equipped with advanced infrastructure, transportation, wastewater treatment systems, and automated manufacturing layouts, NAMCO is strategically positioned to support more stringent emission standards across hybrid and internal combustion vehicle platforms.

- The facility has already requalified the majority of its product portfolio and remains on track to requalify the pending products over the coming months.

- The NAMCO capital project has also been delivered below budget, with estimated total capital expenditures of approximately $70.0 million — $5.0 million below budget.

- Neo has invested $47.8 million in the NAMCO project to date, including $14.2 million in 2024, with remaining expenditures expected by early 2025.

- For this project, Neo has a $75.0 million credit facility from EDC, of which $50.0 million has been drawn to date.

CONTINUED BUSINESS SIMPLIFICATION

- In August 2024, Neo announced that it has entered into agreements to sell an 86% equity interest in its Jiangyin-based rare earth separation facility (JAMR) and a full divestment of its Zibo facility (ZAMR).

- These divestitures target a streamlined operational focus and are anticipated to return cash to Neo, reduce working capital needs, and minimize earnings volatility driven by rare earth price fluctuations.

- The JAMR sale includes a five-year distribution agreement, allowing Neo to maintain access to key high-purity products for its downstream customers while freeing resources from the highly regulated and competitive rare earth separation business in China.

- In August 2024, Neo announced that it has entered into an agreement to sell its 80% equity stake in its gallium trichloride production facility located in Quapaw, Oklahoma.

- The sale aligns with Neo’s strategy to refine its global operating footprint by focusing on high-value downstream applications.

- The transaction is expected to include a seven-year supply agreement with the buyer for ongoing gallium recycling support from its Peterborough, Ontario facility.

- Neo anticipates that each of these transactions will close in Q4 2024.

STRATEGIC REVIEW

- Neo continues to progress its previously announced Special Committee-led strategic review process, which includes the consideration of strategic alternatives and opportunities to maximize shareholder value. The Strategic Committee retained Barclays Capital Inc. and Paradigm Capital Inc. as independent financial advisors who are advancing the strategic review process. Neo’s financial advisors are advancing the strategic review process, and Neo continues to take steps to optimize its business, including the divestment of non-core assets, and the improvement of operational performance, significant customer wins, and progress of major capital projects, both on-time and on-budget. Through these initiatives and Neo’s continuing focus on value-maximizing alternatives, Neo is advancing the strategic review process.

- There can be no assurance that the strategic review process will result in any transaction or other alternative, nor any assurance as to its outcome or timing. There is no timetable for completion of this process.

2024 OUTLOOK

- Neo previously communicated a fiscal year 2024 Adjusted EBITDA(I) outlook of $45 – $50 million. With the outperformance in Rare Metals during the third quarter of 2024, Neo raises its fiscal year 2024 Adjusted EBITDA(I) outlook to a range of $52 – $55 million, an approximate 40% to 48% increase over the prior year.

- For fiscal year 2025, Neo previously communicated a double-digit percentage Adjusted EBITDA(I) growth compared to the original guidance for fiscal year 2024. Notwithstanding the three divestitures anticipated to close by the end of 2024, Neo anticipates fiscal year 2025 Adjusted EBITDA(I) outlook in the range of $53 – $58 million.

CONFERENCE CALL ON THURSDAY, NOVEMBER 14, 2024 AT 10 AM EASTERN

Management will host a teleconference call on Thursday, November 14, 2024 at 10:00 a.m. (Eastern Time) to discuss the third quarter 2024 results. Interested parties may access the teleconference by calling (437) 900-0527 (local) or (888) 510-2154 (toll free long distance) or by visiting https://app.webinar.net/v32pRWbDxgQ. A recording of the teleconference may be accessed by calling (289) 819-1450 (local) or (888) 660-6345 (toll free long distance), and entering pass code 40961# until December 14, 2024.

NON-IFRS MEASURES

This news release refers to certain non-IFRS financial measures and ratios such as “Adjusted Net Income”, “EBITDA”, “Adjusted EBITDA”, and “Adjusted EBITDA Margin”. These measures and ratios are not recognized measures under IFRS, do not have a standardized meaning prescribed by IFRS, and may not be comparable to similar measures presented by other companies. Rather, these measures and ratios are provided as additional information to complement IFRS financial measures by providing further understanding of Neo’s results of operations from management’s perspective. Neo’s definitions of non-IFRS measures used in this news release may not be the same as the definitions for such measures used by other companies in their reporting. Non-IFRS measures and ratios have limitations as analytical tools and should not be considered in isolation nor as a substitute for analysis of Neo’s financial information reported under IFRS. Neo uses non-IFRS financial measures and ratios to provide investors with supplemental measures of its base-line operating performance and to eliminate items that have less bearing on operating performance or operating conditions and thus highlight trends in its core business that may not otherwise be apparent when relying solely on IFRS financial measures. Neo believes that securities analysts, investors and other interested parties frequently use non-IFRS financial measures and ratios in the evaluation of issuers. Neo’s management also uses non-IFRS financial measures to facilitate operating performance comparisons from period to period. For definitions of how Neo defines such financial measures and ratios, please see the “Non-IFRS Financial Measures” section of Neo’s management’s discussion and analysis filing for the three and nine months ended September 30, 2024, available on Neo’s web site at www.neomaterials.com and on SEDAR+ at www.sedarplus.ca.

(1)Neo reports non-IFRS measures such as “Adjusted Net Income”, “Adjusted Earnings per Share”, “Adjusted EBITDA”, “Adjusted EBITDA Margin” and “EBITDA”. Please see information on this and other non-IFRS measures in the “Non-IFRS Measures” section of this news release and in the MD&A, available on Neo’s website at www.neomaterials.com and on SEDAR+ at www.sedarplus.ca

Notes:

- Represents other expense (income) resulting from non-operational related activities, including provisions for damages for outstanding legal claims related to historic volumes. In addition, other income for the nine months ended September 30, 2024 includes the reversal of a special reserve to cover for potential liabilities related to employee safety incidents or workplace accidents at the ZAMR facility. This reserve was released when Neo shut down this operation. These items are not indicative of Neo’s ongoing activities.

- Represents unrealized and realized foreign exchange losses that include non-cash adjustments in translating foreign denominated monetary assets and liabilities.

- Represents share-based compensation expense in respect of the long-term incentive plans (the “LTIP“) which was adopted on May 9, 2018 as well as the Omnibus long-term incentive plan (the “Omnibus LTIP“), which was originally approved by shareholders on June 29, 2021 and amended and approved by shareholders on June 19, 2024. No further grants were made under the LTIP once the Omnibus LTIP was adopted. There are no RSUs and PSUs outstanding under the LTIP and no further grants will be made under the LTIP.

- Represents start-up costs (primarily pre-operational staffing costs) at Neo’s new European sintered magnet facility, as well as transition cost during qualification and start-up of the NAMCO facility and winding down of the ZAMR facility. Neo has removed these charges to provide comparability with historic periods.

- Represents costs related to a comprehensive strategic review of Neo’s current operation strategy and capital structure. These costs primarily consist of professional fees for legal advisors, bankers, and other specialists engaged in evaluating and advising on strategic alternatives aimed at enhancing shareholder value. Neo has removed these charges to provide comparability with historic periods.

- For the three months ended September 30, 2024, an impairment charge of $0.3 million was recorded as a result of the classification of the JAMR and ZAMR disposal group as held for sale. For the nine months ended September 30, 2024, an impairment charge of $0.6 million was recorded as a result of the shutdown of the light rare earth separation business in ZAMR; an impairment charge of $0.3 million as a result of the classification of the JAMR and ZAMR disposal group as held for sale; and a reversal of an asset impairment of $0.4 million previously recorded in Neo’s Rare Metals hafnium business.

- Neo reports non-IFRS measures such as “Adjusted Net Income”, “Adjusted Earnings per Share”, “Adjusted EBITDA”, “Adjusted EBITDA Margin”, “Free Cash Flow” and “Free Cash Flow Conversion”. Please see information on this and other non-IFRS measures in the “Non-IFRS Measures” section of this news release and in the MD&A, available on Neo’s website neomaterials.com and on SEDAR+ at www.sedarplus.ca.

- Includes cash and non-cash capital expenditures of $21.2 million and $54.1 million, respectively, and right-of-use assets of $0.1 million and $3.3 million, respectively, for the three and nine months ended September 30, 2024. For the three and nine months ended September 30, 2023, the amount was comprised of cash and non-cash capital expenditures of $7.8 million and $17.4 million, respectively, and right-of-use assets of $nil million and $2.2 million, respectively.

- Calculated as Free Cash Flow divided by Adjusted EBITDA(I).

Notes:

- Represents unrealized and realized foreign exchange losses that include non-cash adjustments in translating foreign denominated monetary assets and liabilities.

- For the three months ended September 30, 2024, an impairment charge of $0.3 million was recorded as a result of the classification of the JAMR and ZAMR disposal group as held for sale. For the nine months ended September 30, 2024, an impairment charge of $0.6 million was recorded as a result of the shutdown of the light rare earth separation business in ZAMR; an impairment charge of $0.3 million as a result of the classification of the JAMR and ZAMR disposal group as held for sale; and a reversal of an asset impairment of $0.4 million previously recorded in Neo’s Rare Metals hafnium business.

- Represents share-based compensation expense in respect of the LTIP which was adopted on May 9, 2018 as well as the Omnibus LTIP, which was originally approved by shareholders on June 29, 2021 and amended and approved by shareholders on June 19, 2024. No further grants were made under the LTIP once the Omnibus LTIP was adopted. There are no RSUs and PSUs outstanding under the LTIP and no further grants will be made under the LTIP.

- Represents start-up costs (primarily pre-operational staffing costs) at Neo’s new European sintered magnet facility, as well as transition cost during qualification and start-up of the NAMCO facility and winding down of the ZAMR facility. Neo has removed these charges to provide comparability with historic periods.

- Represents other expense (income) resulting from non-operational related activities, including provisions for damages for outstanding legal claims related to historic volumes. In addition, other income for the nine months ended September 30, 2023 includes the reversal of a special reserve to cover for potential liabilities related to employee safety incidents or workplace accidents at the ZAMR facility. This reserve was released when Neo shut down this operation. These items are not indicative of Neo’s ongoing activities.

- Represents costs related to a comprehensive strategic review of Neo’s current operation strategy and capital structure. These costs primarily consist of professional fees for legal advisors, bankers, and other specialists engaged in evaluating and advising on strategic alternatives aimed at enhancing shareholder value. Neo has removed these charges to provide comparability with historic periods.

- Neo reports non-IFRS measures such as “Adjusted Net Income”, “Adjusted Earnings per Share”, “Adjusted EBITDA”, “Adjusted EBITDA Margin”, “Free Cash Flow” and “Free Cash Flow Conversion”. Please see information on this and other non-IFRS measures in the “Non-IFRS Measures” section of this news release and in the MD&A, available on Neo’s website neomaterials.com and on SEDAR+ at www.sedarplus.ca.

About Neo Performance Materials

Neo manufactures the building blocks of many modern technologies that enhance efficiency and sustainability. Neo’s advanced industrial materials – magnetic powders and magnets, specialty chemicals, metals, and alloys – are critical to the performance of many everyday products and emerging technologies. Neo’s products help to deliver the technologies of tomorrow to consumers today. Neo’s business is organized into three segments: Magnequench, Chemicals & Oxides, and Rare Metals. Neo is headquartered in Toronto, Ontario, Canada; with corporate offices in Greenwood Village, Colorado, United States; Singapore; and Beijing, China. Neo has a global platform that includes 9 manufacturing facilities located in China, the United States, Germany, Canada, Estonia, Thailand and the United Kingdom, as well as one dedicated research and development centre in Singapore. For more information, please visit www.neomaterials.com.

Information Contacts

| Irina Kuznetsova | George Gretes |

| Director, Investor Relations | Communications & Media |

| (416) 367-8588, ext 7334 | (416) 367-8588, ext 7331 |

| Email: ir@neomaterials.com | Email: media@neomaterials.com |

Cautionary Statements Regarding Forward Looking Statements

This news release contains “forward-looking information” within the meaning of applicable securities laws in Canada. Forward-looking information may relate to future events or the future performance of Neo. All statements in this release, other than statements of historical facts, with respect to Neo’s objectives and goals, as well as statements with respect to its beliefs, plans, objectives, expectations, anticipations, estimates, and intentions, are forward-looking information. Specific forward-looking statements in this discussion include, but are not limited to, the following: expectations regarding certain of Neo’s future results and information, including, among other things, revenue, expenses, sales growth, capital expenditures, and operations; statements with respect to current and future market trends that may directly or indirectly impact sales and revenue of Neo, including but not limited to the price of rare earth elements; expected use of cash balances; continuation of prudent management of working capital; source of funds for ongoing business requirements and capital investments; expectations regarding sufficiency of the allowance for uncollectible accounts and inventory provisions; analysis regarding sensitivity of the business to changes in exchange rates; impact of recently adopted accounting pronouncements; risk factors relating to intellectual property protection and intellectual property litigation; risk factors relating to national or international economies, geopolitical risk and other risks present in the jurisdictions in which Neo, its customers, its suppliers, and/or its logistics partners operate, and; expectations concerning any remediation efforts to Neo’s design of its internal controls over financial reporting and disclosure controls and procedures. Often, but not always, forward-looking information can be identified by the use of words such as “plans”, “expects”, “is expected”, “budget”, “scheduled”, “estimates”, “continues”, “forecasts”, “projects”, “predicts”, “intends”, “anticipates” or “believes”, or variations of, or the negatives of, such words and phrases, or state that certain actions, events or results “may”, “could”, “would”, “should”, “might” or “will” be taken, occur or be achieved. This information involves known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in such forward-looking information. Neo believes the expectations reflected in such forward-looking information are reasonable, but no assurance can be given that these expectations will prove to be correct and such forward-looking information included in this news release should not be unduly relied upon. For more information on Neo, investors should review Neo’s continuous disclosure filings that are available under Neo’s profile at www.sedarplus.ca.